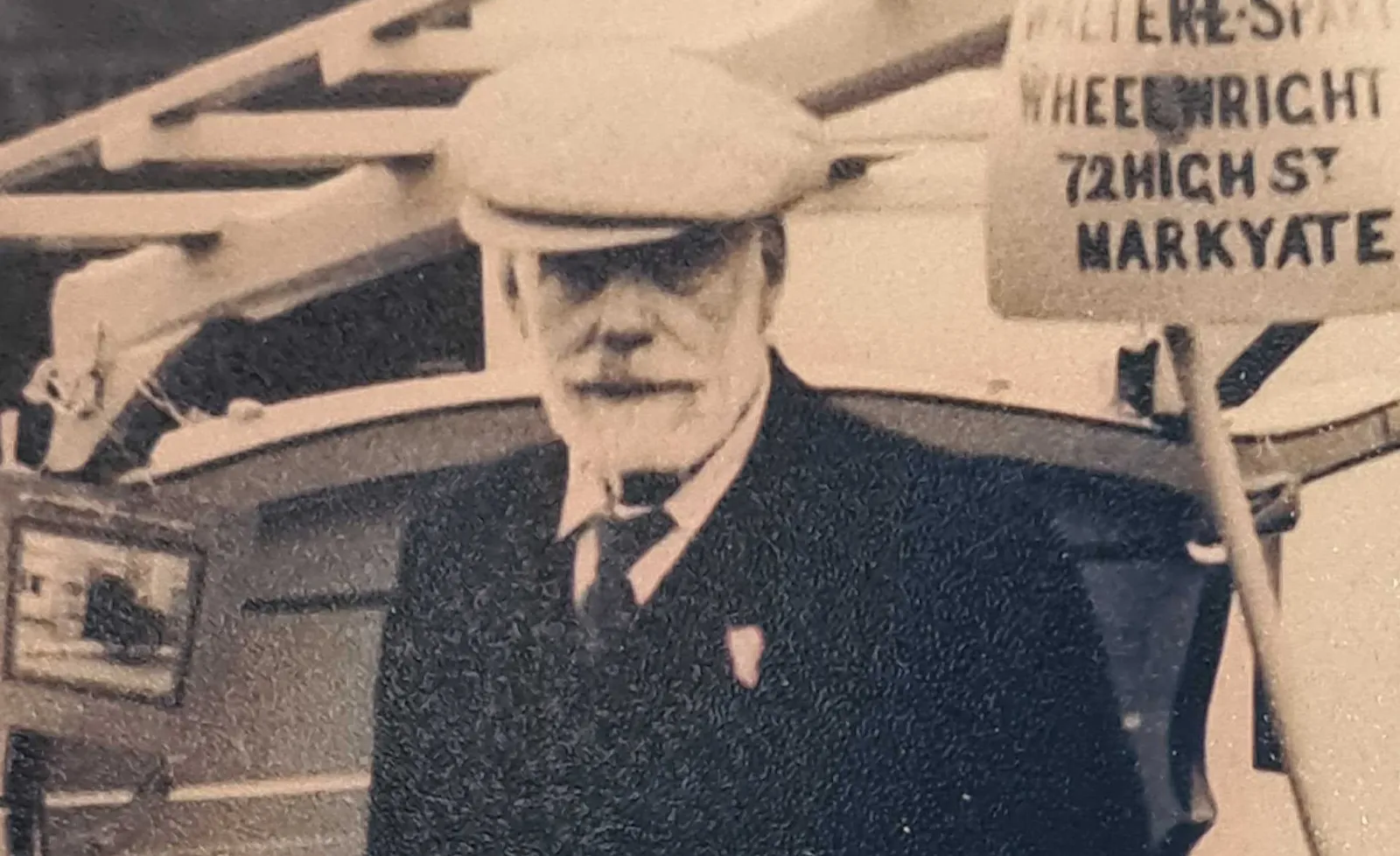

Walter E. Spary, Wheelwright, Markyate (c. 1910s)

Pictured outside his workshop at 72 High Street, Markyate, Walter Spary — my great-great-grandfather — was one of the last traditional English wheelwrights. The Spary family served the local farming and transport community along Watling Street for generations, building and repairing wooden cart and carriage wheels as the village moved from the horse-drawn era into the age of motor vehicles. His original painted sign still survives on the building today — a small but enduring mark of his craftsmanship.

Simon O'Dell

Executive MBA | Co-founder, Insurtech Australia | Co-founder, AuditCover | Managing Director, VIZ Insurance | Managing Director & Partner, Insurtech Gateway Australia

My Background

I’m Simon O’Dell, Managing Director of VIZ Insurance and Managing Director & Partner at Insurtech Gateway Australia Pty Ltd (ITGA) — the venture-builder dedicated to accelerating insurance innovation.

My path started with more than ten years as an insurance broker, where I saw firsthand how complex, outdated processes created high value chain friction and left customers frustrated and under-insured. That experience shaped my mission to design better, fairer insurance.

I hold an Executive MBA, and over the years I’ve built and scaled several ventures in the insurtech ecosystem — from co-founding Insurtech Australia, the nation’s peak body for insurance innovation, to co-founding AuditCover, a successful startup that automates tax audit insurance for accounting firms.

The Origin Story: A Family of Tradies

Insurance isn’t abstract to me — it’s personal.

I grew up in a family of tradies: my dad was a builder, and a few of my brothers are tradies. I’ve seen the risks, long hours, and financial uncertainty that tradies live with, and how “traditional” insurance rarely fits how they actually work.

That’s why VIZ Insurance struck such a chord. I see it as more than a company; it has a purpose to be what insurance should be — built in plain English, priced fairly, feature packed — using the latest in technology, and designed for the everyday tradies.

Why I (and ITGA) Invested in VIZ

At Insurtech Gateway Australia, our mandate is to back founders who are solving deep, systemic problems in insurance. When I encountered VIZ, led by a small but driven team with genuine empathy for tradespeople, I saw something rare:

- Authenticity. VIZ speaks more tradie language than incumbent insurance jargon.

- Clarity. The cover is transparent, the pricing is fair, and the process is quick.

- Purpose. Insurance that gives back to the tradie community through sponsorships, education, and community engagement.

VIZ embodies the future of specialty MGA models — nimble, tech & data-driven, and customer-obsessed.

What We’re Building

At VIZ, we’re creating a platform that lets tradespeople quote, bind, and manage policies within minutes. But more importantly, we’re creating trust. That means:

- Clear communication about what’s covered and what’s not.

- Products tailored for real trades — not generic “SME insurance.”

- Community engagement that celebrates the people building Australia.

We aim to lead the way on how niche insurance brands connect with their audiences — starting with tradies.

Connect

For thought leadership, interviews, or collaboration opportunities, connect with me on LinkedIn or explore how VIZ Insurance is reshaping tradie cover at vizinsurance.com.au.