Cleaners; Sweep Away your Worries with VIZ Insurance

We’re experts in helping cleaners get insured. Get coverage that helps keep your business spotless.

What makes a Cleaner's Insurance policy?

We know that you know you best. That's why we give you the tools to build your own tradies insurance policy across our three coverage types: Public & Products Liability (AKA Legal Liability), Tools & Equipment, and Tax Audit.

THE FOUNDATION

Public & Products Liability Insurance

Why You Might Need It

As a cleaner, you face the risk of damaging your client's or another third party's property or causing bodily injury.

This is the type of situation where Public Liability Insurance can become handy. As long as your claim met the conditions of the policy, your Legal Liability would cover the cost of the damage to your client's property, up to your cover limit.

How It Works

Choose from $5, $10 or $20 million of cover. This is the maximum amount payable by the insurer for any one loss or in the policy period.

$10 million of coverage is the most common legal liability limit taken among our portfolio of Gardeners, Lawn Care and Landscaping professionals over the sample period.* Often, a tradie will choose a limit ($5M, $10M or $20M) based on the requirements of a contract. For example, if you have a contract with a real estate agent to maintain their clients' properties, they might ask you to maintain a minimum of $20 million coverage. Every business is different, so be sure to consider your own needs when selecting a limit.**

THE REINFORCEMENT

Tools & Equipment Insurance

Why You Might Need It

If you're a Gardener, Lawn Care & Landscaping professional, you likely have tools and equipment that you need in order to complete jobs and get paid. That's why they may be worth protecting with more than lock and key. For a lot of tradies, no tools or equipment can mean no work.

Unfortunately, the theft of tools & equipment around Australia is on the rise. $33 million worth of tools were stolen from Victorian tradies alone in 2023, up from $20 million worth in 2022 (crimestatistics.vic.gov.au). Losses often occur after a forced break-in to a locked ute, toolbox, van, trailer or garage. Tools & Equipment Insurance is designed to protect you if your tools and equipment are stolen or sustain loss or damage caused by an insured peril.

How It Works

Tools & Equipment Insurance is an optional extra in your policy; you can add it to Legal Liability when creating your policy. If you ever wish to add it to your policy down the line, you can always give us a call or send us an email.

Tools and Equipment cover starts with $5,000 of cover for unspecified tools and equipment. Each unspecified tool and unspecified piece of equipment has a cover limit of $1,000 per item. To cover any tools and equipment valued over $1000, such as vacuums or carpet cleaners, you simply need to individually specify these on the policy. In your policy, you can have up to $20,000 worth of these specified tools and equipment. Coupled with the initial $5,000 of unspecified equipment, Tools of Trade Cover offers up to $25,000 in total cover.

THE FINAL TOUCH

Tax Audit Insurance

Why You Might Need It

The ATO can audit taxpaying entities at their discretion, regardless of suspicion, fault or evidence. Some taxpaying entities are selected for audit at random, some are selected based on the profile of their lodgements.

If you favour protecting your cashflow against unforeseen professional fees following a tax audit, you may want to consider adding this optional extra to your policy.

How It Works

Tax Audit Insurance is an optional extra in your policy, meaning that you're not required to take out the cover. If you ever wish to add it to your policy in the future, you can always get in touch with us and we can update it for you.

You can either opt in or out of $50,000 of Tax Audit cover for your cleaning business, and if you opt in, you can select an excess that is suitable for you.

And finally... Tax Audit Insurance

Tax Audit Insurance is designed to cover costs such as accountant fees incurred from an audit by the Australian Taxation Office (ATO). Having audit insurance can allow you to go without the worry and compromised cash flow from paying unexpected fees in responding to a tax audit.**

What could the price look like for my cleaners insurance?

We have given you a few examples here so you can get the gist of how much tradies insurance can cost.

POLICIES

Policy Examples

The following policy examples are based on fictional people and are provided to demonstrate how much a premium may be for various types of coverage.

Meet Nathan

Nathan, a domestic cleaner from NSW, got $5 million Legal Liability cover and skipped tools cover, for a Monthly Payment of around $29.***

Meet Sarah

Sarah, another domestic cleaner, from WA, chose $10 million Legal Liability cover and insured $5,000 worth of tools, for a Monthly Payment of around $65.***

Meet Melissa

Melissa, a domestic cleaner from QLD, opted for $20 million Legal Liability cover, insured $8,000 worth of tools, and included $50K Tax Audit cover, for a Monthly Payment of around $92.***

Want to see what we can do for you?

Want to build your own policy and see how we can help you?

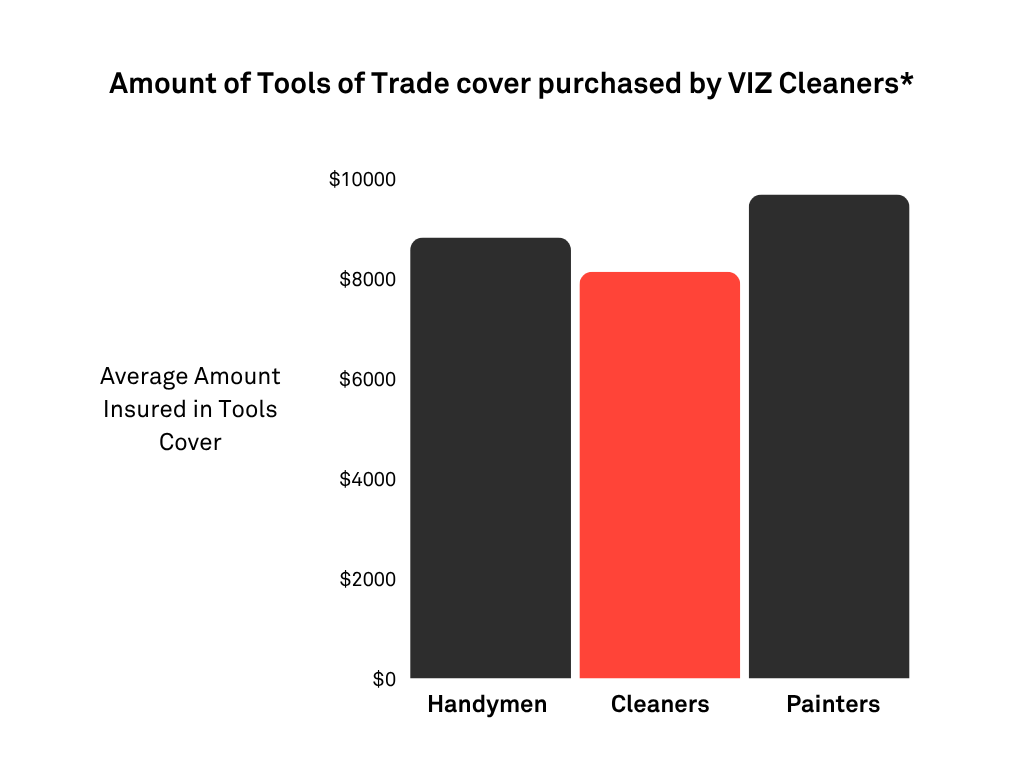

*All data is based upon VIZ Insurance portfolio experience, covering a sample four-year period.

**Any advice provided is general advice only and you should consider if it suits your needs. Please read the relevant Policy Wording to ensure the product is right for you. All product information contained within this website is subject to policy terms and conditions (including exclusion and limitations).

***Monthly Payments vary by state due to state-based stamp duty charges. VIZ charge an annual $25 Policy Fee + GST payable in addition to your premium. The prices shown are based on selecting; $500 excess, a business operating in NSW and is an indication only. Your premium will be calculated based on the information you provide to us during the insurance application process.