Which trades get most value from their insurance?

Insurance is a unique product; customers purchase insurance with the view to never use it, given the use of insurance arises from an unforeseen loss which no one wants to happen to them.

When losses inevitably occur, it can be highly valuable to claim on your insurance. Value from insurance can be measured by the amount claimed.

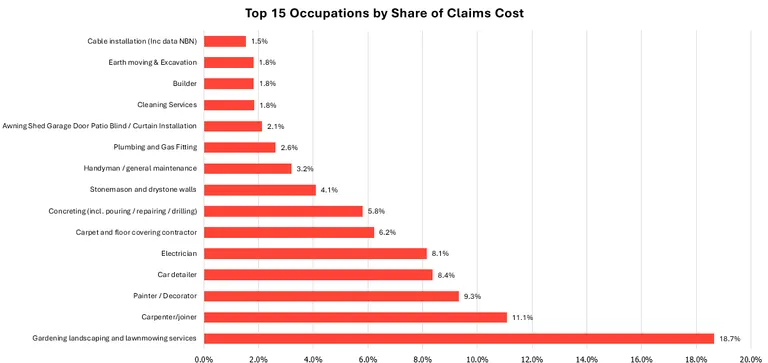

The top 15 occupations by share of total claims paid are as follow:

- Gardening landscaping and lawnmowing services 18.7%

- Carpenter/joiner 11.1%

- Painter / Decorator 9.3%

- Car detailer 8.4%

- Electrician 8.1%

- Carpet and floor covering contractor 6.2%

- Concreting (incl. pouring / repairing / drilling) 5.8%

- Stonemason and drystone walls 4.1%

- Handyman / general maintenance 3.2%

- Plumbing and Gas Fitting 2.6%

- Awning Shed Garage Door Patio Blind / Curtain Installation 2.1%

- Cleaning Services 1.8%

- Builder 1.8%

- Earth moving & Excavation 1.8%

- Cable installation (Inc data NBN) 1.2%

Whilst these trades represent the top 15, VIZ trade occupations number 90+.

Top 15 Occupations by Share of Claims Cost

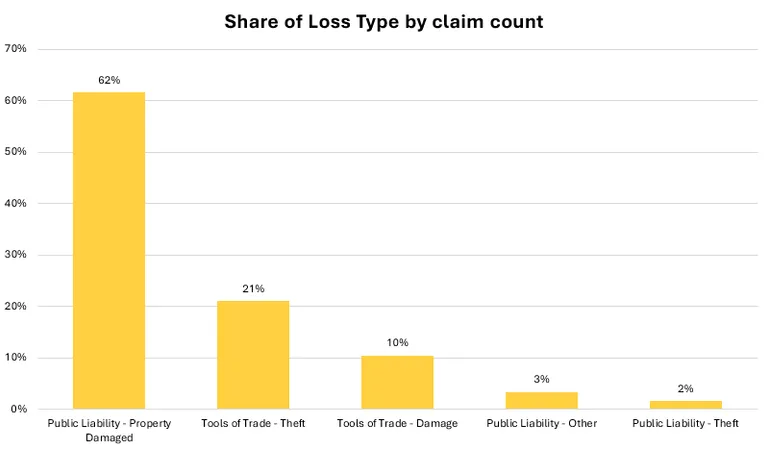

What Loss Type occurs most frequently?

Public liability - Property Damage claims dominate the top 7 list, followed by Tools Theft and Tools Damage.

- Public Liability - Property Damaged 62%

- Tools of Trade - Theft 21%

- Tools of Trade - Damage 10%

- Public Liability - Other 3%

- Public Liability - Theft 2%

Share of Loss Type by Claim Count

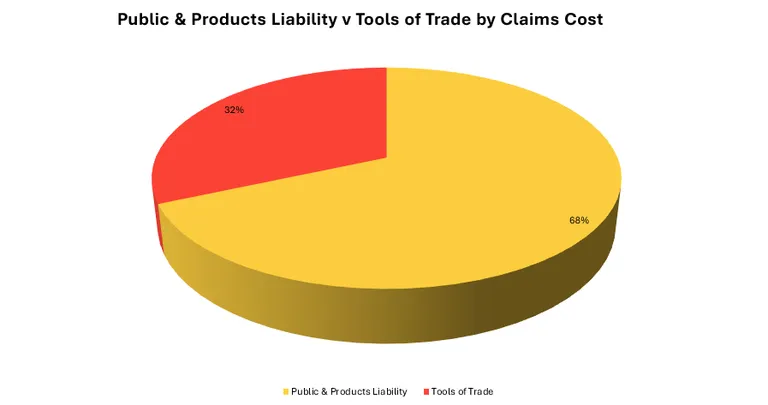

Public & Products Liability v Tools of Trade

Claims costs skew to Public & Products Liability when compared to Tools of Trade on the basis of claims cost paid. 68% of claims costs paid over the period were for Public & Products Liability claims, and 32% Tools of Trade. 76% of Tools of Trades claims costs were for Tools Theft claims and 24% for Damaged Tools.

- Public & Products Liability 68%

- Tools of Trade 32%

What does this mean for Tradies?

- Just about 100% of the value of insurance comes at claim time.

- Public Liability - Property Damage claims represent the largest single category of claim by claims costs paid and claim count.

- 3 out of every 4 Tools of Trade claim is for Theft.

- Gardening landscaping and lawnmowing services take more claims payments than any other trade, followed by Carpenter/joiners, Painter / Decorators, Car detailers and Electrician, with the next 70+ making up the long tail.

Methodology & Date Notes

The data referenced in this article covers claims paid by the underwriter of VIZ Insurance over a 4 year period. Total Claims Costs includes Fees. Claims by Count refers to claims that were accepted and paid. Claims data covers Public & Products Liability and Tools of Trade and excludes Tax Audit.