Public & Products Liability Insurance

Also called Legal Liability Insurance, this type of cover is designed to help with third-party injury or property damage linked to your business activities

What is Public & Products Liability Insurance?

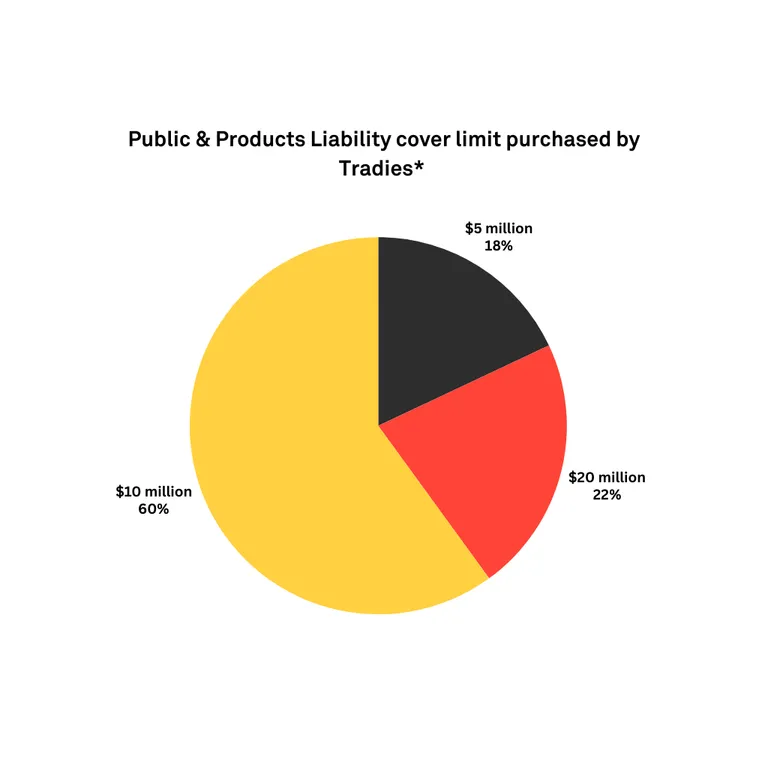

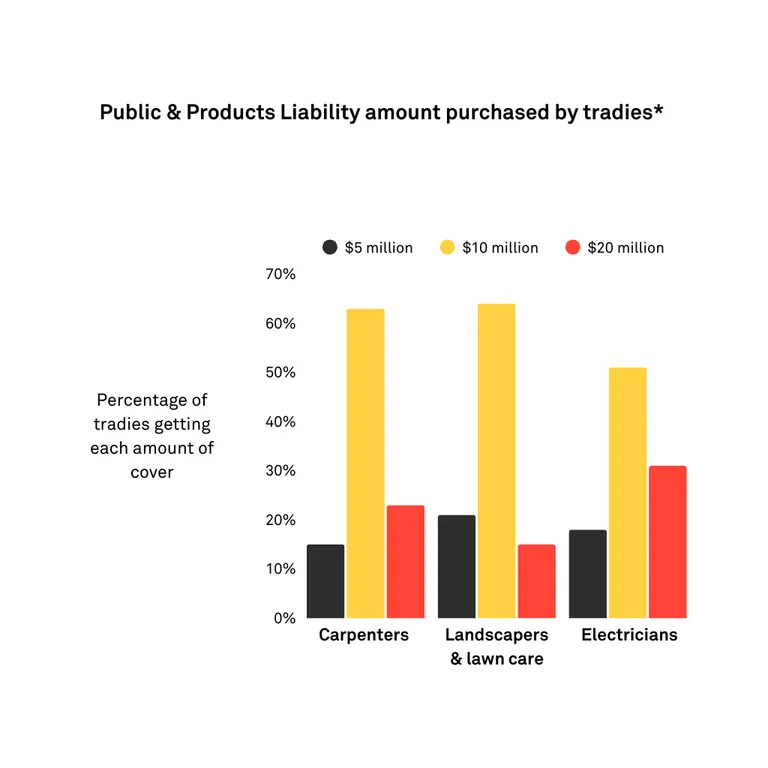

VIZ Public & Products Liability Insurance, also known as Legal Liability Insurance, is an insurance package designed for Australian tradies, and it includes both Public Liability Insurance and Products Liability Insurance. You can choose from $5 million, $10 million, or $20 million of cover for your business.

Public Liability Insurance

Public liability insurance can cover you if a third party claims they were injured or their property was damaged because of your work. For most tradies, this can mean anything from a client tripping over your tools, to accidentally taking out a door when working in a client's house. It’s designed to protect your livelihood by covering the legal and compensation costs, so one mishap doesn’t leave you out of pocket - or out of business.

Product Liability Insurance

Products liability insurance can cover you if someone claims they were injured or their property was damaged because of a product you’ve sold, supplied, or installed. This includes products you’ve installed or provided that’s no longer in your physical possession. For tradies, this could apply to installed materials, fixtures, or appliances. This cover can provide protection by covering legal and compensation costs if these products lead to a claim. Be sure to refer to the policy wording for full details on what’s covered, including any exclusions or conditions.

Frequently Asked Questions - Public & Products Liability Insurance

How much you'll pay for your Public & Products Liability Insurance depends on a few key factors - we've listed a few below.

Your occupation

Different trades carry a different level of risk. A plumber working with gas has different, usually higher, risks to a carpenter. Due to these increased risks, the plumber will typically pay more than a carpenter for their Public Liability Insurance.

The number of employees

The number of employees in the business will also impact the price of a tradies public liability insurance. Obviously, more people on the tools means more potential for things to go wrong - and that increases the cost of covering those risks.

The amount of coverage

Another factor affecting the premium that you pay is the amount you choose to be covered for. You can choose between $5 mil, $10 mil, or $20 mil of Public & Products Liability coverage. Of course, if you choose $10 million of cover rather than $20 million, you are going to pay less. Even a brickie could figure that out ;)

The amount of public and products liability insurance you choose comes down to your appetite for risk and your circumstances.

We have found that a lot of our customers choose their limit based off requirements of a contract, for example with a Real Estate Agent or head contractor. We also see some customers getting Public & Products Liability Insurance in order to meet the requirements of a certain license, such as QLD or WA electricians.

VIZ Tradies Insurance includes Public & Products Liability Insurance, which can cover you or your employees accidentally causing property damage or personal injury to a third party.

VIZ understands that Tradies are often multiskilled and that some tradies perform activities that that could fit within a second business activity. On your VIZ policy, you can get covered for up to two occupations - e.g. handyman and landscaper, carpenter and renovator, or maybe electrician and cleaner (if you happened to be the first ever electrician to pick up a broom).

Grab a Quote in Less Than 2 Minutes

Your search for insurance could be over in 120 seconds.

*data is based upon a sample of VIZ Insurance customers over a four year period