Why Now? Understanding Professional Indemnity Insurance for Tradies

Across Australia, the insurance and regulatory landscape for builders, landscapers, and other trades is changing.

Recent reforms — particularly in New South Wales — are acknowledging the scope of liability for design and advice, and many tradies are discovering that their current Public & Products Liability policies were never intended to cover those risks.

1. Why Now?

In July 2026, Professional Indemnity insurance will become mandatory for registered design and building practitioners in NSW under the Design and Building Practitioners Act 2020.

The Act also introduced a statutory duty of care, meaning that anyone involved in the design or construction of a building owes a duty to exercise reasonable care to avoid economic loss — and that duty applies for up to 10 years after completion.

Other states are reviewing similar reforms:

State/Territory | Current or Emerging Requirement | Relevant Law / Regulator

NSW | PI insurance required for registered design and building practitioners from 1 July 2026 | Design and Building Practitioners Act 2020.

VIC | PI insurance required for registered building designers | Building Act 1993 (VIC) / Victorian Building Authority.

QLD | PI insurance required for licensed building designers | Building (Professional Indemnity Insurance) Amendment Regulation 2020.

ACT | PI insurance required for professional engineers from 6 March 2025 | Professional Engineers Act 2023.

WA, SA, TAS, NT | No universal PI mandate yet, but regulators are consulting on reform and many government contracts already require it | State building regulators / relevant licensing bodies.

Even where PI isn’t yet mandated, contracts and principal contractors are increasingly requiring evidence of PI cover before engagement. The “why now” is that the legal and commercial environment has moved — not just the legislation i.e. where an economic loss is sustained by a third party due to a faulty design or poor advice, the third party is increasingly seeking compensation from the provider of such design or advice. State governments are recognising this and using regulatory reform to encourage — and in some cases force — tradies to purchase PI cover to fill the protection gap.

2. Understanding Risk Exposure

Most trades are covered for physical risks — injury to third parties or damage to property — under their Public and Products Liability (PPL) cover.

However, those policies are not designed to respond when a customer suffers financial loss because of your professional advice, design, or supervision.

Examples of activities that can create a PI exposure include:

- A landscaper who provides a garden or drainage design.

- A builder who issues or modifies plans, coordinates subcontracted design elements, or signs compliance declarations.

- A plumber who specifies or designs a hydronic or solar water system.

- An electrician who designs lighting layouts or advises on system capacity.

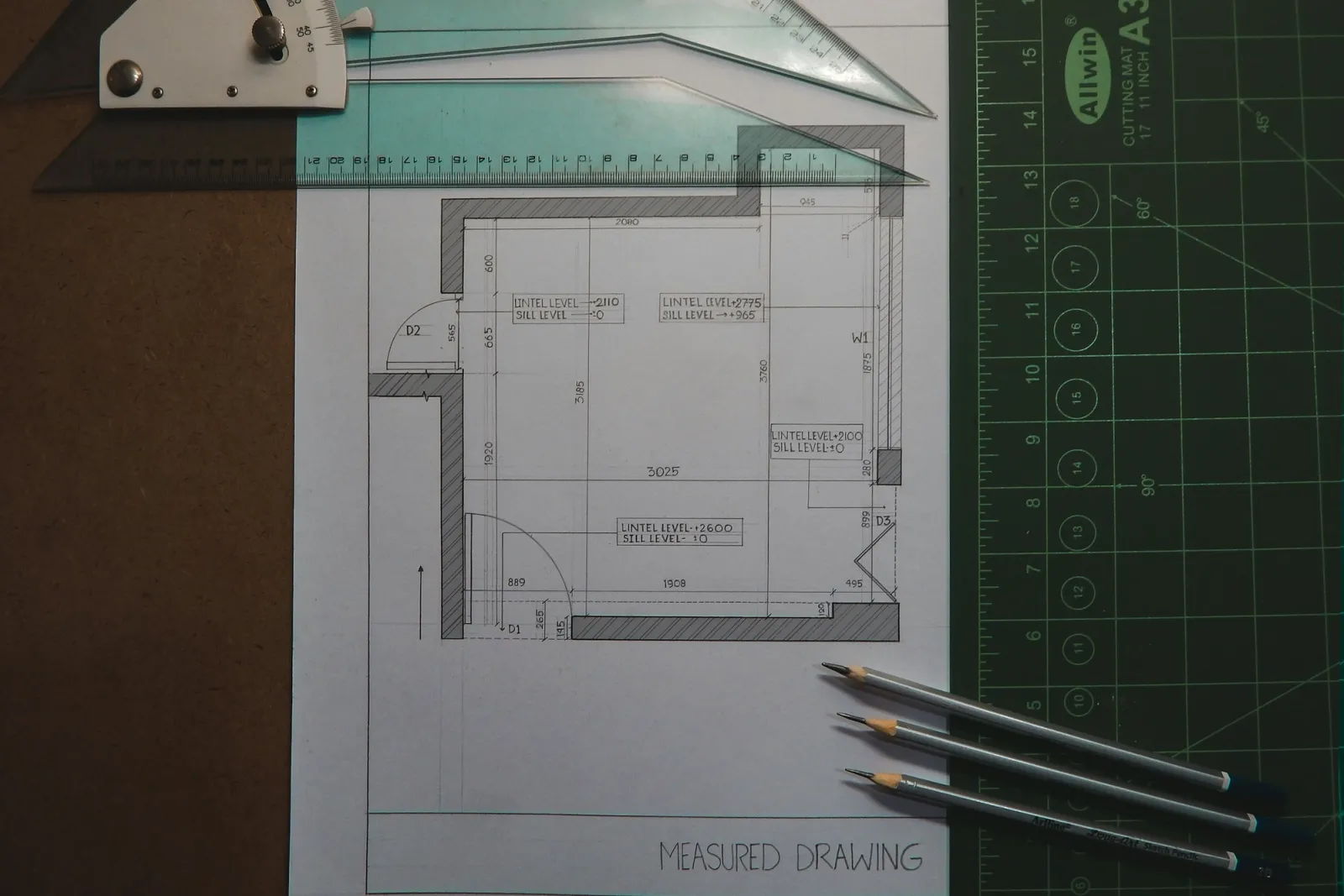

- A carpenter or builder who provides drawings or measurements used for approval.

- A contractor who issues compliance statements or certificates for completed work.

These are all examples of professional services — work involving judgment, design, or advice rather than purely technical craftsmanship or labour.

When something goes wrong, the customer’s claim often isn’t that “you caused damage”, but that “your advice or design caused me financial loss.”

That type of claim generally sits outside PPL cover.

3. Why Public and Products Liability (PPL) Doesn’t Respond

In Australia, Public and Products Liability products are generally designed to respond to:

- Accidental injury to a third party, or

- Accidental damage to property,

that arises directly from your business activities.

It is not designed to cover financial loss that results from a professional mistake, omission, or design fault.

In plain language:

- If a beam you install fails because it wasn’t fastened correctly, causing damage to the property — that’s likely Public Liability territory, because it involves physical damage resulting from your work.

- If the same beam fails because you advised the client or drafted a plan specifying a beam that was undersized for the load, that’s a professional error — a design or advice mistake that results in financial loss rather than direct damage — and PPL is unlikely to respond.

This distinction — between physical loss and financial loss due to advice or design — is the key dividing line between PPL and PI insurance.

4. What Professional Indemnity (PI) Insurance Is Designed to Cover

PI insurance is designed to protect a business that provides advice, design, or other professional services against claims for financial loss caused by an error, omission, or negligent act in the course of those services.

In general terms, a PI policy is designed to cover:

- Legal defence costs if a client alleges you made an error or gave misleading advice.

- Compensation payable for the financial loss suffered by the client as a result.

- Historical work, where the error occurred before the current policy (subject to the retroactive date and a being a ‘claims-made’ policy).

- Run-off cover, for claims that arise after you stop trading.

However, PI is not a cure-all. It’s not designed to cover defective workmanship, physical damage, or deliberate acts, and it generally operates on a claims-made basis — meaning the policy must be active when the claim is made, not when the work was done or loss sustained.

5. Timing and Emerging Trends

Even outside of statutory requirements, PI exposure has grown for many trades because of:

- Integrated contracts that combine design and construction under a single party (“Design & Construct”).

- Client expectations for advice and design input on even small jobs.

- Longer liability tails, where defects or design failures may only become apparent years after completion.

- Contractual changes, where builders, designers, and subcontractors are being asked to show proof of PI as a condition of work or funding.

Given these shifts, the practical question for most trades is not “Am I legally required to hold PI?” but rather “Am I providing any advice or design that could create a financial-loss risk?”

6. Practical Considerations

If you’re unsure whether PI exposure applies to your work, consider these indicators:

- Do you provide drawings, specifications, or layouts as part of your service?

- Do clients rely on your advice when making material or structural decisions?

- Are you registered as a building or design practitioner under state law?

- Do you sign off on design compliance or issue certification documents?

If any of these apply, it may be prudent to review your insurance arrangements to ensure your risks are properly addressed.

7. The Direction of Reform

State regulators are moving toward clearer standards for design and advisory roles:

- NSW: Mandatory PI insurance for registered practitioners from 1 July 2026; statutory duty of care already in effect.

- VIC: PI insurance required for registered designers under the Building Act 1993.

- QLD: PI insurance required for building designers under the 2020 regulation.

- ACT: PI required for registered engineers from March 2025.

- WA, SA, TAS, NT: Consultation and industry review under way, with many government projects already requiring PI as a condition of tender.

These reforms are consistent in one message: the law increasingly distinguishes between physical and professional risk — and the latter is being regulated more explicitly.

8. In Summary

Public & Products Liability insurance is designed to protect against physical harm or damage caused by your work.

Professional Indemnity insurance is designed to protect against financial loss resulting from your advice, design, or professional service.

Even where PI is not yet mandatory, the combination of longer liability periods, integrated design-build models, and evolving regulation means it is becoming part of the standard toolkit for many trades.

9. Where to Learn More

If you’re a tradie, builder, air conditioning technician or landscaper wanting to understand whether PI exposure may apply to your work, VIZ can connect you with a licensed insurance broker who specialises in trade and construction professions.

In parallel, the VIZ technology and insurance team are developing a Professional Indemnity extension for the VIZ Trade Pack policy, so that qualified trades can include PI cover alongside their existing protection.

Until then, the best next step is education — understanding where your exposure begins and ends under current cover.

This article is written for information purposes only — any recommendation provided by VIZ is general advice only and doesn’t take account of your particular needs and circumstances.