Even plumbers find the pressure of business insurance draining.

We’re experts in helping plumbers get insured. Craft a policy that fits your business.

What makes a Plumbers Insurance policy?

We know that you know you best. That's why we give you the tools to build your own tradies insurance policy across our three coverage types: Public & Products Liability (AKA Legal Liability), Tools & Equipment, and Tax Audit.

We start with Public & Products Liability Insurance

Legal Liability is included in every VIZ policy and consists of Public Liability Insurance and Products Liability Insurance. These are designed to cover you for costs that arise from third party claims against your work, or products that you use for work.

THE FOUNDATION

Public & Products Liability Insurance

Why You Might Need It

As a Plumber, you face the risk of receiving a claim for compensation for damaging your client's or another third party's property or causing bodily injury.

The types of claims that our Plumbing clients receive are varied. An example is where the plumber was alleged to have not crimped a pipe properly, causing water damage in the roof of a third party's property.

Whilst every claim is different, it is this type of situation where Public & Products Liability Insurance can become handy.

How It Works

Choose from $5, $10 or $20 million of cover. This is the maximum amount payable by the insurer for any one loss or in the policy period.

It is ultimately up to you to decide how much cover you need. Be sure to consider factors like potential claims cost for personal injury to third parties, and remember that different amounts of coverage attracts different premiums. Every Plumbing business is different, so be sure to consider your own needs when selecting a limit.

Then you can add Tools & Equipment Insurance

Tools & equipment insurance is an optional extra which you can add to your Public & Products Liability to create your tailored Plumbers insurance policy. You can cover up to $25,000 of tools and equipment to protect yourself if they are stolen, or sustain loss or damage caused by an insured peril.

THE REINFORCEMENT

Tools & Equipment Insurance

Why You Might Need It

If you're a plumber, you likely have tools and equipment that you need in order to complete jobs and get paid. That's why they may be worth protecting with more than lock and key. For a lot of tradies, no tools or equipment can mean no work.

Unfortunately, the theft of tools & equipment around Australia is on the rise. $33 million worth of tools were stolen from Victorian tradies alone in 2023, up from $20 million worth in 2022 (crimestatistics.vic.gov.au). Losses often occur after a forced break-in to a locked ute, toolbox, van, trailer or garage. Tools & Equipment Insurance is designed to protect you if your tools and equipment are stolen or sustain loss or damage caused by an insured peril.

How It Works

Tools & Equipment Insurance is an optional extra in your policy; you can add it to Legal Liability when creating your policy. If you ever wish to add it to your policy down the line, you can always give us a call or send us an email.

Tools and Equipment cover starts with $5,000 of cover for unspecified tools and equipment. Each unspecified tool and unspecified piece of equipment has a cover limit of $1,000 per item. To cover any tools and equipment valued over $1000, such your trailer, drain machine, or press guns, you simply need to individually specify these on the policy. In your policy, you can have up to $20,000 worth of these specified tools and equipment. Coupled with the initial $5,000 of unspecified equipment, Tools of Trade Cover offers up to $25,000 in total cover.

And finally... Tax Audit Insurance

Tax Audit Insurance is designed to cover costs such as accountant fees incurred from an audit by the Australian Taxation Office (ATO). Having audit insurance can allow you to go without the worry and compromised cash flow from paying unexpected fees in responding to a tax audit.

THE FINAL TOUCH

Tax Audit Insurance

Why You Might Need It

The ATO can audit taxpaying entities at their discretion, regardless of suspicion, fault or evidence. Some taxpaying entities are selected for audit at random, some are selected based on the profile of their lodgements.

If you favour protecting your cashflow against unforeseen professional fees following a tax audit, you may want to consider adding this optional extra to your policy.

How It Works

Tax Audit Insurance is an optional extra in your policy, meaning that you're not required to take out the cover. If you ever wish to add it to your policy in the future, you can always get in touch with us and we can update it for you.

You can either opt in or out of $50,000 of Tax Audit cover for your plumbing business, and if you opt in, you can select an excess that is suitable for you.

Want to see what we can do for you?

Get a quote in less than 2 minutes.

How we calculate Public & Products Liability premiums for Plumbers

At VIZ Insurance, our pricing is transparent and formula-based — no hidden fees, no surcharges for monthly payments. Here’s how we calculate a plumber’s premium

1. Questions we ask first

a). Do you perform any gas work?

Answer:

Base premium (based on 1 employee, $10m cover limit)

Yes: $767.81

No: $513.29

b). How many employees do you have (including yourself)?

We ask- please enter the number of full-time employees – this should include full time equivalents for any part time employees and casual employees and/or labour hire employees.

Employees of third party contractors and subcontractors should not be included.

(based rate on $10m cover limit)

Plumbing (incl. gas work)

1 Employee: $767.81

2 Employees: $913.70

3 Employees: $1,186.96

4 Employees: $1,475.41

5 Employees: $1,797.18

Plumbing (no gas work)

1 Employee: $513.29

2 Employees: $600.26

3 Employees: $772.78

4 Employees: $950.33

5 Employees: $1,149.22

If you have six or more employees, your business falls outside our small-business eligibility for VIZ Tradies Insurance.

2. Cover limit — choose your level of protection

Once we know your occupation and employee count, we apply a cover limit factor to calculate the total base premium.

Plumbing incl. gas work

1 Employee: $5m cover $639.79 | $10m cover $767.81 | $20m cover $896.02

2 Employees: $5m cover $761.30 | $10m cover $913.70 | $20m cover $1,066.47

3 Employees: $5m cover $989.27 | $10m cover $1,186.96 | $20m cover $1,384.26

4 Employees: $5m cover $1,229.74 | $10m cover $1,475.41 | $20m cover $1,720.32

5 Employees: $5m cover $1,497.77 | $10m cover $1,797.18 | $20m cover $2,096.60

Plumbing (no gas work)

1 Employee: $5m cover $427.70 | $10m cover $513.29 | $20m cover $598.99

2 Employees: $5m cover $500.18 | $10m cover $600.26 | $20m cover $700.34

3 Employees: $5m cover $643.84 | $10m cover $772.78 | $20m cover $902.12

4 Employees: $5m cover $792.00 | $10m cover $950.33 | $20m cover $1,108.41

5 Employees: $5m cover $957.66 | $10m cover $1,149.22 | $20m cover $1,340.66

3. Taxes and Policy Fee

We then apply:

- GST: 10 % of base premium

- Stamp Duty: Based on your primary operating state (see table below)

- Policy Fee: $27.50 (includes GST) - flat annual administration fee

State Based Stamp Duty rates applied on (base + GST)

ACT 0 %

NSW 0 %

QLD 9 %

VIC 8 %

SA 11 %

WA 10 %

NT 10 %

TAS 10 %

We simply ask: “In which state do you primarily operate?”

4. How we calculate the total

Total Annual Payable = Base Premium (adjusted based on the number of employees and the cover limit selected) + GST + Stamp Duty + $27.50 (policy fee including GST)

You can pay yearly or monthly.

We don’t charge extra for monthly payments — it’s the same total divided evenly, with the $27.50 fee included in your first payment.

This helps tradies manage cashflow more easily.

5. Example: Ben the Plumber with gas work, 1 employee, $5 million cover limit, primarily operates in NSW)

Base Premium $639.79

GST (10 %) $63.98

Stamp Duty (NSW 0 %) $0.00

Policy Fee (incl. GST) $27.50

Total Annual Payable: $731.27

Monthly payments:

$58.65 × 12 months + $27.50 Policy Fee payable in the first month only.

6 a. Key points to remember

- Prices are based on our rating model as at 2 November 2025 which remain current today.

- This information is general only, not personal advice. See our Policy Wording to determine if the product is right for you.

6 b. Eligibility & Declarations (before we can offer cover)

Whether we offer cover or not depends on other questions and declarations as follows:

i) Duty of Disclosure & Electronic Communication Agreement

I have read and agree to the Duty of Disclosure and Policy Wording. I agree to VIZ providing any policy documents, policy related communications and tax payment receipts electronically only.

Before entering into this insurance contract, you have a duty to tell us anything that you know, or could reasonably be expected to know, as it may affect the insurer's decision to insure you and on what terms. You must answer our questions honestly, accurately and to the best of your knowledge. This duty applies to you and anyone else insured under the policy. If you answer for another person, we'll treat your answers as theirs. Your duty continues until we insure you. If you don't meet this duty, we may cancel your policy or treat it as if it never existed. Your claim may also be rejected or not paid in full. Please read and make sure You understand your Duty of Disclosure.

If the business primarily operates in NSW we also add the following into the declaration, which means the user generates <$2,000,000 in turnover and gets charged 0% duty charge.

NSW stamp duty exemption

Small businesses in NSW as defined in Section 259A of the Duties Act 1997 (NSW) are eligible for an exemption from Stamp Duty for certain classes of insurance. If you are not eligible for this exemption, this insurance product is not suitable for you.

ii) The below statement is correct

Confirmation

Please confirm the following statements

The business owners, principals or directors have not:

- suffered bankruptcy or been convicted of a criminal offence in the past 7 years.

- been declined a claim as a result of insurance fraud in the past 7 years.

- had more than 3 business related claims in the last 3 years.

- received business related claim payments totalling more than $35,000 in the last 3 years.

- your aggregated turnover last year and likely turnover this year are less than $2,000,000.

7. Question set (for calculators or chat assistants)

If you’re chatting with our bot (or another assistant), it’ll ask:

- Do you perform gas work?

- How many employees (including you)?

- What level of cover do you want? ($5 m, $10 m, $20 m)

- What state do you primarily operate in?

FAQs

A: Yes, each additional employee slightly increases the base rate. Use our calculator for exact figures.

A: If you confirm you’re a small business under Section 259A of the Duties Act 1997 (NSW), we automatically apply a 0% duty. The primary criteria is that you turnover <$2,000,000.

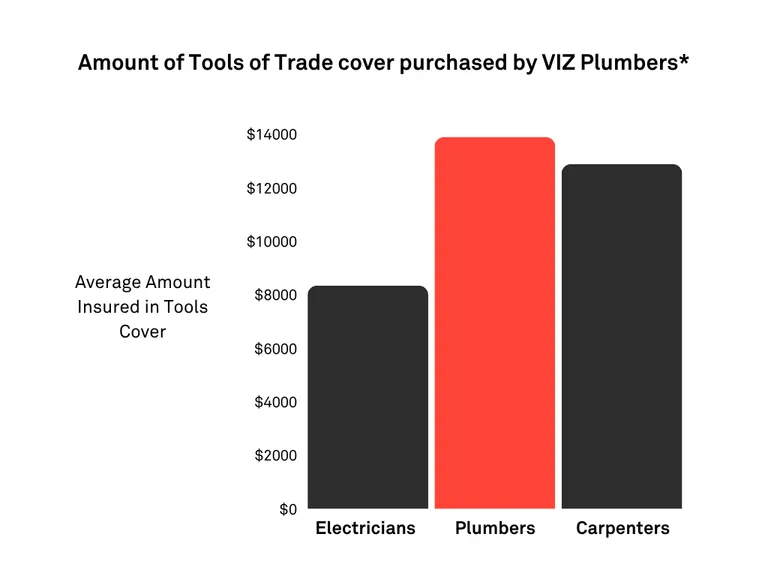

*All data is based upon VIZ Insurance portfolio experience, covering a sample four-year period.